The Rise of a New Social Media: Poshmark

An analysis of the business model and growth of Poshmark

Ebay, Etsy, Facebook Marketplace, and now…Poshmark. Poshmark is a platform where people can buy and sell used clothing. Founded in 2011, the platform now has 60 million community members and 100 million items for sale. With malls dying out and the disruption to the economy due to COVID-19, online secondhand shopping is a faster, safer, more convenient alternative accessible to all people.

Founding and Growth

Manish Chandra, one of the four co-founders of Poshmark, first founded Kaboodle in 2005, an integration of social media and shopping for home decor. He believed that by formating it as a social media platform. users would be more engaged and be able to connect more personally with others. After selling the company to Hearst for $30 million in 2007, he then began working on Poshmark with Tracy Sun, Gautam Golwala, and Chetan Pungaliya. It was founded first to be a way for women to make money selling extra clothing from their closets. Chandra believed, “the way you could introduce people to new fashion is through people, not brands.” With the iPhone 4 release in 2010, Chandra realized that releasing an iPhone app could significantly broaden the customer base. Additionally, during a time soon after the Great Recession, people were eager to find new ways to make extra money.

In their first year, they had about 1,000 users. Their user base continued to grow and by the end of 2013, people were uploading a million dollars worth of merchandise a day. Some of their merchants were making over $100,000 a year. They almost went bankrupt when their servers couldn’t keep up with the large user growth on their platform.

Initially, Poshmark has secured $3.5 million in Series A financing, led by the Mayfield Fund. This was followed by $12 million in Series B funding led by Menlo Ventures in 2012, $25 million in Series C funding led by Inventus Capital Partners in 2015, $25 million in series D funding led by GGV Capital in 2016 and $87.5 million in series R funding led by Temasek Holdings in 2017.

In their last public valuation in 2017, they were estimated to be worth $625 million. In 2018, they had $140 million in revenue, an increase from $50 million in 2016. They planned to go public in 2019, but then decided to focus their efforts on improving the Poshmark experience. Today, their company has more than 2,000 employees.

Recent Expansions

In 2015, Poshmark launches Poshmark Wholesale, which allows sellers to buy bigger quantities of inventory to sell in their store. These sellers get price discounts and make greater profits.

In June 2019, Poshmark launched Poshmark Home, which allows users to buy and sell home goods to diversity their platform. They followed this with Posh Stories in April 2020, where users could develop videos to market their products. After seeing the success of Snapchat/Instagram stories and how users are drawn to short quick videos like TikTok and Instagram Reels, it was definitely a smart decision to introduce Posh Stories.

Finally, on September 25, 2020, Poshmark announced their IPO in a press release where they’ll offer Class A common stock to the public. They have already filed their S-1 form with the SEC.

The stats below are representative of how active the social media platform is.

How it works and competitive advantage

Poshmark is a social media platform where people can buy or sell clothes, accessories, and a few other goods. Its simple platform makes it appealing to all users. To sell, users need to take a picture, add a quick description, set the price and they’re set. Once the item is purchased, Poshmark will give the seller a pre-paid, pre-addressed label to put on the box and get it picked up from home for free. As a buyer, you can follow sellers, explore brands and categories, bookmark likes, and set sizes.

Unlike their competitors ThredUp and RealReal founded at a similar time, Poshmark allows individuals to handle the selling and pricing. Additionally, it focuses on building a social network, rather than buying just from people you know. You can follow other users, follow styles/trends, and share listings with your own followers. They have daily “posh parties” that let people browse a certain theme. On each listing, people can ask questions about the product or ask for help in styling themselves. This fashion advice addition to Poshmark creates a more collaborative platform, where people form stronger connections with other site users.

In malls, many people just roam around the store, without looking for something specific. Even for those who do have a specific idea in mind, they often end up browsing for longer. Items for sale, wording, music, colors, and everything else you could think of are strategically placed to make people spend more time in the mall and spend more. However, on online shopping sites, customers usually search for a specific item they are looking for, browse through the selection, order it, and leave the site. Thus, people are avoiding the extra spending. Poshmark creates the mall environment through its social media style approach with a feed. Customers can browse through other’s selections and styles, which may cause them to spend more. The average Poshmark user opens the app at least seven times a day totaling 20-25 minutes, similar to other social media platforms like Facebook and Instagram.

Poshmark is a platform inclusive to everyone regardless of gender, age or socioeconomic status. While the company began for woman’s clothing, it’s expanding into menswear, kid’s clothing, plus sizes, luxury goods, makeup and home decor. As of 2018, one in five new users were male. People can also choose the price range of clothing they are looking for.

Poshmark has created a self-sustaining ecosystem within itself. With the money sellers make on the platform, it’s easy for them to purchase new items straight from the site. In 2019, 48% of Poshmark sellers used part of their earnings to make their own Poshmark purchases. Poshmark has created a new subsector for the shopping industry. If people don’t like something or stop using it, they know they can sell it on Poshmark. This creates a less stressful shopping experience. 92% of Poshmark users sold items on the platform that they couldn’t return to the original retail outlet. Additionally, 76% of people in a survey consider an item’s resale value before purchasing, and 66% consider the resale value when shopping for luxury items.

Poshmark makes money through commissions on peer-to-peer sales. For every sale under $15, the company charges a flat fee of $2.95 and for any sale above $15, they charge a 20% commission. They consider any item over $500 as a luxury good and Poshmark authenticates it. Boutique sellers are merchants that are more professional like small brick and mortar stores. They get a boutique tag indicating that the products are authentic, new, and of good quality. Sellers need to pay $20 to get a boutique seller certificate.

Additionally, Poshmark has been a great platform for influencers to advocate for certain causes and advertise their own brands. Fashion bloggers and celebrities have large wardrobes that they can share with their fans and allow them to shop their closets. Poshmark invites fashion influencers to throw live Posh Parties to connect with their fans and spread the word about Poshmark and promote themselves. Celebrities like Alex Morgan, DJ Khaled, and Serena Williams are all on Poshmark selling many of their old clothes.

Similar to Tiktok, anyone can become famous on the platform from scratch and become an influential Seller Stylist because of the millions of users on the platform. For example in 2012, Suzanne Canon, a common everyday woman, decided to start casually selling on Poshmark. She quickly got roped in and soon made $1 million in sales from selling secondhand clothing.

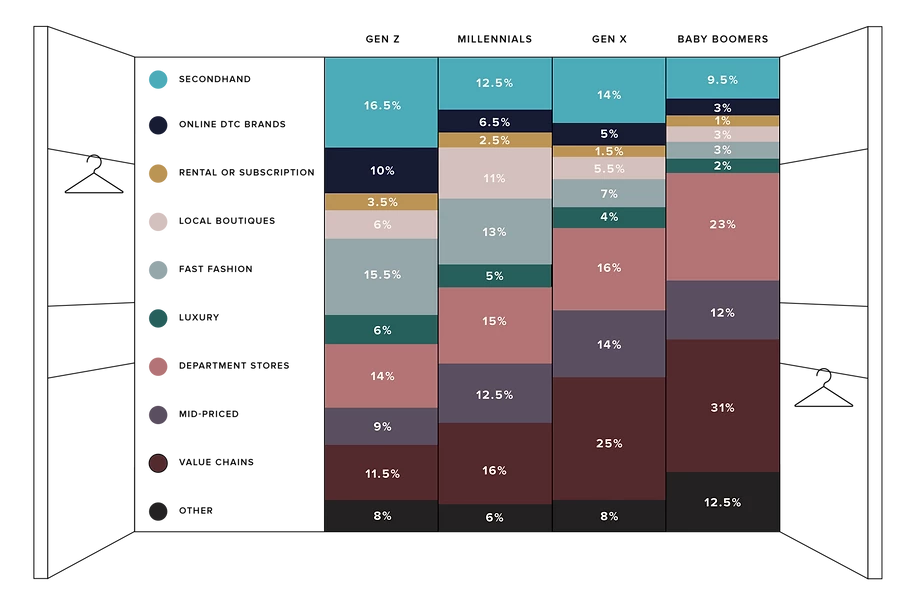

Poshmark users on average have 38% secondhand clothing in their closets compared to the 14% average American closet. Gen Z owns more secondhand clothing than generations before. They are also becoming more active in the selling. 41% of Gen Z users have made up to $5000 on Poshmark and 10% of Gen Z users have earned up to $10,000.

To close this section, here are a few stats about Poshmark sellers:

94% of U.S. Poshmark shoppers purchase from sellers out of state.

Around half of Poshmark users sell part time and use it as a side-hustle, but 22% of users sell full time in the US and 16% sell full time in Canada.

45% of Poshmark sellers have repeat customers.

41% of Poshmark sellers in the U.S. and Canada have styled customers at some point on the platform. Half of members who have exchanged advice made a sale or purchase as a result of that interaction.

Shopping Industry

The global retail industry is growing. It’s expected to grow 4.1% this year, amidst the economic uncertainty and has been growing around 4.7% for the past 6 years. There are over 1 million retail establishments across the US. The apparel market is expected to grow faster than the retail industry at 10.2% CAGR from 2020 to 2025. Women’s apparel makes up for the largest segment of the apparel industry.

The $29 billion secondhand apparel market will nearly double to $51 billion by 2023 according to the ThredUp report, which uses research and data from retail analytics firm GlobalData. According to the report, in 2018, about 6% of clothes were secondhand. That number is projected to grow to 13% within 10 years and reach one-third by 2033.

According to America’s Research Group, a consumer research firm, about 16 - 18% of Americans will shop at a thrift store during a given year. The resale market grew 25 times faster than the overall retail market last year, with an estimated 64 million people buying secondhand products in 2019.

COVID 19 accelerated the resale market as budgets are getting tighter and people turn to cheaper alternatives. 4 in 5 people say they are open to shopping secondhand when money gets tight. Also, 79% of consumers plan to cut their apparel budget in the next 12 months due to COVID-19. Finally, 2 in 3 people who have never sold their clothes are now open to it. Their main reason is to make money.

As companies are realizing this, they are beginning to incorporate secondhand sales in their companies. In April 2019, Neiman Marcus bought a minority stake in Fashionphile, which resells secondhand designer accessories. In July 2019, luxury brand Mark Cross said it was launching a resale online shop where customers can trade in or buy pre-owned Mark Cross products.

75% of people are comfortable ordering items directly from someone online. Poshmark is among the most popular platforms to purchase from, alongside Instagram and Facebook Marketplace. Selling on Poshmark is a form of working in the gig economy. A gig economy includes temporary, flexible jobs that companies hire as independent contractors and freelancers rather than full time employees. The gig economy can benefit workers, businesses, and consumers by making work more adaptable to the needs of the moment and demand for flexible lifestyles. As the gig economy continues to grow, Poshmark will be an appealing choice for many in the laborforce.

Social media has a strong influence in apparel sales. Ninety percent of social marketers said investing in social media has a direct effect on revenue. Eighty-nine percent of marketers use Facebook for brand marketing, ahead of Instagram (65%), Twitter (50%), YouTube (49%), Messenger (44%), LinkedIn (38%), Snapchat (28%) and Pinterest (28%). Eighty-three percent of consumers are on Facebook, and 66% said they "like" or "follow" a brand profile on the social network.

Approximately 20% of Poshmark users are Gen X and in 2019, approximately 1 in 4 people joining Poshmark were Gen Z. 57% of Gen Z discover new brands via influencers on social platforms. Gen Z is significantly more likely to take their style cues from social media influencers (34%), their peers (48%), celebrities and pop culture icons (37%), and streetwear (38%) than older generations.

As malls are dying out, there has been a transition to e-commerce. One in four U.S. malls is expected to close by 2022, according to a 2017 report by Credit Suisse.

About 90% of occupants in U.S. malls are either experiential tenants like movie theaters, or department store chains and apparel retailers, according to the Coresight analysis. This makes malls the most vulnerable type of shopping centers to the Covid-19 impact, it said, compared with other properties like strip centers that have grocery stores and outlet centers that offer consumers bargains.

The online sector facilitated 12 percent of commerce in 2019 according to the Commerce Department, beating general merchandize stores including department stores, warehouse clubs and super-centers. Clothes and sports good are some of the most bought items online according to Statista. This transition to e-commerce has been accelerated by COVID-19 as more people are staying and ordering from home.

As I alluded to earlier, Poshmark has two main competitors. One of their largest competitors is the RealReal, a marketplace focused on luxury goods. This includes jewelry, watches, and home decor. Similar to Poshmark, they handle the authentication process and handle writing the product descriptions and determining the price of the listing. They take between 15 and 45 percent of the sale. They raised close to $350 million in 10 rounds of funding and went public in June 2019, raising another $300 million. Their stock now trades at $14.30 as of EOD 11/25/20.

Another competitor in the field is thredUp, a virtual marketplace where people send uses goods for sale. They accept over 35,000 brands, many of which are more affordable. They take higher percentages off goods to make up for the lower priced items. They have raised over $380 million in 8 funding rounds, but haven’t shared their revenue.

Sources

https://public.com/learn/what-to-know-about-poshmarks-2020-ipo

https://www.uschamber.com/co/good-company/launch-pad/retailers-fuel-resale-trend#:~:text=The%20%2429%20billion%20secondhand%20apparel,from%20retail%20analytics%20firm%20GlobalData.&text=By%202023%2C%20resale%20is%20expected,and%20grow%20to%20%2423%20billion.'

https://www.narts.org/i4a/pages/index.cfm?pageid=3285

https://www.cnbc.com/2020/06/23/thredup-resale-market-expected-to-be-valued-at-64-billion-in-5-years.html

https://www.mobilemarketer.com/news/90-of-marketers-see-revenue-impact-from-social-media-survey-says/554204/

https://www.washingtonpost.com/business/2019/11/22/malls-are-dying-only-these-ones-have-figured-out-secrets-success-internet-age/

https://www.cnbc.com/2020/08/27/25percent-of-us-malls-are-set-to-shut-within-5-years-what-comes-next.html

http://www.oecd.org/coronavirus/policy-responses/e-commerce-in-the-time-of-covid-19-3a2b78e8/

https://poshmark.com/posh_guide

https://www.forbes.com/sites/sanfordstein/2019/09/19/will-resale-retail-prevail-and-is-secondhand-becoming-first-priority/?sh=160fb65763c2

https://www.forbes.com/sites/bizcarson/2018/12/14/next-billion-dollar-startups-how-a-serial-social-shopping-entrepreneur-built-poshmark-from-used-clothes-into-a-625m-retail-empire/?sh=7e96c6561150

https://www.bizjournals.com/sanjose/news/2014/02/20/poshmarks-manish-chandra-why-mobile.html

https://nrf.com/insights/economy/state-retail

https://closetassistantpm.com/celebrities-on-poshmark/

https://www.businessinsider.com/poshmark-seller-makes-1-million-dollars-2018-6